I declare this experience to be the whole truth, nothing but the truth, so help me God.

Feel free to email me at pettprojects@yahoo.com if you would like me to add your name (first name, initial of last name and your state only will appear) to my list of disgruntled State Farm Auto Insurance customers at the end of this document.

WE are their bread and butter, and even though the amount in question is minute, it's most definitely the principle of the situation!

Share this page on your social media to alert other potential customers to State Farm's practices. Their Facebook page is @statefarm and their Twitter page is @StateFarm.

This is a very long and detailed document, so brace yourself.

I rent a room in a friend's house in Fountain, Colorado. This summer (2017) my friend had a visitor stay for a few months while he was repairing her RV. She needed to have auto insurance on her old 1980 RV and received a good rate from a local State Farm Auto Insurance agent in early July 2017. I heard about the good rate and called the agent to ask about a rate for my 2000 Toyota Corolla. (The insurance company I was using at the time was putting up their rates for the second time in 12 months and I didn't think that was fair, so I was in the market for a new auto insurance company.) I called and spoke to Brandon. I mentioned that this woman got a good rate from him and asked if he would give me a quote. (This was the last I knew of the RV insurance as her business was none of mine.) I gave him all my details and he quoted me a rate of $124.49 for liability only for six months. (I can't afford to have much more than the state minimum.) I thought that was a good rate and asked if he could hold that quote for me until early September when I would be back from a trip and would then be ready to cancel my current insurance at the end of the month and start with State Farm on the 1st of October. He said that it shouldn't change and that he'd hold it for me in the system. (I should mention that at this stage, nothing was mentioned about how this rate was determined or that there were any discounts associated with it. Nothing whatsoever.) I left it at that and said I would contact him again early September, which I did.

I gave him a call around September 11th and asked if the quote was still good. He confirmed that it was. I said that I could come and see him in a few days, which I did, and I took along the papers from my current auto insurance company. He made copies of them so that he'd have all the details at his fingertips. I left saying that I would come back in a few days with the cash and we can take out the policy. I returned on the 20th of September with the cash and paid for the first six months. He asked me to sign on the electronic pad and I asked what I was signing for as I had not seen any paperwork at this stage. He said I was signing that I had paid and that I was getting insurance cards. He printed out a receipt and temporary auto identification cards. I noticed that my name was incorrectly spelled so I signed again and he printed them out again. Then I noticed that the start date was 22 September 2017 which was incorrect as I asked to start on the 1st October 2017. Once again I signed and he printed out the pages again. The receipt was for $123.29 and stated "Total of 6 month premium" and "Payment Received $123.29" and "Balance due $0.00". Here is a copy of that receipt. (Please click on the thumbnail and again on the picture so that it enlarges and is legible.) He thanked me and told me that the rest of the documents and permanent auto identification cards would be mailed to me. Again, I have to state that nothing was menioned about any discounts applied to the quoted rate.

On the 29th of September I received a package in the mail with my insurance booklets, the Declarations Page (which had a policy total of $160.41 on it, also saying "this is not a bill"), a little square gadget that said State Farm "Technology by Cambridge Mobile Telematics", and a flyer that explained how to download the Drive Safe & Save app. A letter dated 22 September 2017 was also enclosed stating that I "opted to participate in Drive Safe and Save Mobile" and what I should do to use it. I immediately called Brandon and asked him what this was for as I had never heard of it let alone "opted to participate". I told him that I didn't have a phone connected to the internet (I only have wi-fi) and this wouldn't work for me as I didn't want to be "followed". He didn't explain it to me but said very clearly that, "It's not on your policy and it's not compulsory and it won't affect your policy or rates". Relieved, I asked if I should return the gadget to him and he said I need not return it. One of the points in the enclosed letter said, "If you are currently receiving a premium reduction for low estimated annual mileage, your premium may increase at a future policy renewal if the calculated annual mileage no longer meets those criteria". This is what prompted me to ask about my policy and/or rates changing, as well as why the new rate on the Declarations Page! I asked again if by not using the Safe Drive & Safe gadget my rates would increase and he reiterated that they would not increase! (At this juncture he had still not mentioned or explained any discounts whatsoever.)

Letter with the Drive Safe & Save gadget and the Declarations Page

Also on the 29th of September I received an invoice in the mail for $37.12 payable by October 25, 2017. There were no details on the invoice as to why I was being billed, so I spoke to Brandon again and asked him why I was getting an invoice without any details on it. He told me he didn't know what it was for and that I should ignore it. Nothing had changed on my policy he said. The date of the invoice was 09-22-17, two days after I paid for my 6-month policy in cash and in full.

My goodness, if another invoice doesn't arrive on the 9th October! This time it was dated Oct 02 2017 and was for $43.51 with another rate increase to $166.80 and payable by Nov 02 2017. This time it stated "Policy Changes made recently: Drive Safe & Safe (TM) Removed". I called Brandon again and asked why I was being billed again! (I didn't say that the invoice stated Drive Safe & Safe was removed as I wanted to hear if he knew this time why I was being billed.) He looked up on his computer and said that it was the "multi-car discount" that was removed. I said I didn't have a second car so why was I being billed? He said that I was given a discount because there was someone else at my address who had an auto insurance policy with State Farm and the computer gave me a discount. I said that wasn't what "multi-car" discount means. I said it surely means if the insurer has a second car. He said that was not what it meant and that State Farm gives discounts to people who live at the same address and who are also insured with them. I queried this insisting that this is not right and that how is a person supposed to know what other people in the house (none of us are related in any way, shape or form) do with their private state of affairs, and that how would I know if she cancels or not, and if she did, that was none of my business and I shouldn't be affected. He insisted this wasn't the case and that it was because we lived at the same address. I asked to make an appointment with Kreg Kell, the agency manager, and he was away that week until Friday 13th October when I went in at 1.30pm.

On Friday the 13th October at 1.30pm I met with Kreg in his office. I asked him if it was okay for me to record our meeting and he said it was okay. (The day before this meeting I learned that the woman whose RV was insured with this State Farm agent received an invoice dated 12 September 2017 without any details as to why she was being billed $380.20 for the next six months. Apparently they tried to contact Kell's agency but no one would take their calls and no one returned their calls. I assume her policy was cancelled shortly thereafter but I can't be certain as I never spoke to her about it. It wasn't any of my business. She left our address on 26 September 2017. I learned that her initial policy was on a month-to-month basis and she was paying $7.00 a month. The invoice she received two months later was for $380.20 without any details as to what she was being billed for!!!!

I had all my papers with me and I asked Kell why I received an invoice without any information on it asking for $37.12 and an increase to $160.41. I then asked why I received another invoice for $43.51 with a further rate hike to $166.80. He insisted that the second invoice (which clearly states it was for the removal of the Safe Drive & Save option) was for the removal of the multi-car discount, which I again challenged, and was once again told, verbatim, that "it's strictly based on your location..." and it applies to more than one person living at the same address and not an insured person's second vehicle! I explained to him that I had nothing to do with the other woman's private business and shouldn't have to be penalized if she decided (unbeknownst to me) to cancel her policy! I also told him that I was NOT told about any discounts when I signed up and have never been told about any discounts! I said that had I been told I was getting a multi-car discount I would have said that I don't have a second car and we would have thrashed it out there and then, but it wasn't mentioned and we didn't discuss it! I also would have said that I didn't want the Drive Safe & Save option as I don't have internet on my phone, but it wasn't mentioned and we didn't discuss it. I mentioned that I didn't like the underhanded and deceptive ways State Farm tries to get more money out of clients and he didn't say anything. I asked how he can make this go away and suggested he could make it right by calling his billing department or by paying the difference himself (meaning his office could pay) to which he said that legally he is not allowed to. He said I have two options: one to pay the increased rate or not pay it and the policy cancels. I then said I was going to take this further. I left the meeting saying that I was very unhappy and that I would be taking this up with Channel 11's Call for Action, which I did, and they referred me to the Colorado Department of Insurance who filed on my behalf with State Farm.

Upon returning home I called the State Farm office in Illinois and was told in no uncertain terms, by a very abrupt "supervisor" in the customer care department, that I could not and would not be allowed to speak to anyone in the corporate office and that I have to take it up with my agent. She wasn't budging.

I also called seven local State Farm agents and posed the same question to them, asking them to explain what State Farm's policy was on multi-car discounts. Six of the seven replied that it means the insured person's second car or a spouse's car or a child's car all living at the same address, NOT people living at the same address.

On the 27th October I received a reply via UPS Express from State Farm's corporate office dated 25 October 2017. They said that "Since you were referred by an existing State Farm policyholder residing with you (not with me, at the same address as mine), the multi car discount was inadvertently included in the initial automobile quote due to the team member's misunderstanding of the discount eligibility criteria." (That's not my fault and they should have contacted me and told me but they did not. They never mentioned this multi-car discount. EVER.) They also very incorrectly said in this letter (my italics), "In addition, the Drive Safe and Save discount was also added to your initial quote after a team member provided a general overview of program benefits and discount. The agency's general business practice is to add the Drive Safe & Save discount only after the program benefits have been discussed with the applicants." (WRONG. This never happened. They are lying because I would have mentioned that I don't have a phone with internet and wouldn't want the Safe Drive & Save, and I also would have disputed the "multi-car" discount.") They went on to say that, "After a thorough underwriting review of consumer reports and application information for your household, an automobile policy was issued for the policy period effective October 1, 2017 to April 1, 2018 at the correct premium of $160.41. (WRONG. I was issued a receipt for 6 months and paid in cash the amount of $123.29 on September 20, 2017. You cannot go back on your quote two days later and increase the rate without even discussing it with the policyholder! This is plain wrong! I was not given the option of accepting or rejecting this increase!)

Further, "Your automobile policy was issued at the higher premium than the original quoted auto application due to the removal of the multi-car discount. In order to be eligible for the multi-car discount, there has to be two or more automobiles, used principally by persons residing in the same household and insured with State Farm Insurance Company. The automobiles must be owned by one or more individuals in the household who are related by blood, marriage, or adoption. (This is what I disuputed with Kell and was met with his insistence that I was incorrect! And why wasn't this put on the first invoice?) Your initial down payment of $123.29 was applied towards the policy premium during issurance, resulting in a balance due of $37.12 which was mailed to you on September 25, 2017. A second balance due notice was mailed on October 2, 2017 for $43.51 as a result of a policy change request to remove the Drive Safe and Save discount from your 2000 Toyota policy". (Brandon told me not to worry about it, to ignore it, it won't affect your policy or your rates and it's not compulsory.) The letter went on stating, "In further review of your concerns and agent's summary of initial conversations and contacts exchanged between you and his agency during the quoting and policy issurance time period, we understand an error was made during the quoting process for your automobile insurance that resulted in the increase in the premium charged to you." (If so, why didn't anyone call me to alert me to this error and to discuss what could be done about it? NO ONE called me or mentioned any discounts I was receiving!) More, "Unfortunately, we are not able to adjust the issued premium to match the quote you had received. During the initial underwriting review period for new auto applications, company placement and eligibility, including premiums quoted are adjusted after consumer reports and correct household information are verified. (This would have been the time to contact me to discuss any increase and to ask if I was happy with an increase or what we could do about it. NO ONE contacted me, they just went ahead and invoiced me (without an explanation on the invoice!!!) and now won't correct their error.) In order to ensure that all policyholders are treated fairly and equitably, policy premium is issued in accordance with the filed rating rules and discounts filed with the Colorado Department of Insurance; therefore, were are not able to honor the original quoted premium". (The Colorado Department of Insurance completely agreed with me and offered to pursue this investigation.)

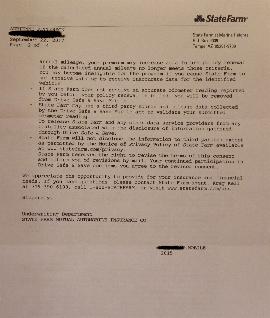

Please see State Farm's letter to me in its entirety.

State Farm's Explanatory letter

I called Kell on Friday 27th October (he had also received a copy of the above letter) and he was very subdued and apologized for the mistake that his office made and thanked me for bringing it to his attention and that they are undergoing further training for staff members. (I also recorded this message where I asked him to confirm that I will be refunded on the $123 and not the $160 and he said yes, the $123 because I didn't pay the $160.) I emailed him on Monday 30th October and asked him to confirm via email that I would be refunded a pro-rated amount based on the $123.29 I paid and not on the figure of $166.80 that they are asking for. He did reply and these are our messages:

From: Adrienne Petterson [mailto:pettprojects@yahoo.com]

Hello Kreg,

His reply:

I have sent through a request to cancel your Toyota Corolla policy effective midnight 11/1/2017. Thank you for the opportunity to work with you and we will get a pro-rated refund mailed out within 30 days.

Thank you,

Kreg

My follow-up:

Yes, but I need confirmation that it will be pro-rated on $123.29.

His reply:

Adrienne,

I just finished speaking with my auto service department. They informed me that the refund will be a pro-rated amount of your $123.29 that you paid, but the refund will be based on the correct 6 month premium of $166.30 as this was the accurate premium for the 6 month policy.

Thank you,

Kreg

My next email to him:

From: Adrienne Petterson [mailto:pettprojects@yahoo.com]

No, no, no, no!! This is not correct. You told me on Friday that I would definitely be refunded on the $123.29 and NOT on the $160 or $166 fee! I have to go back to the Department of Insurance to let them know. This is not fair or right!

His last reply:

Kreg Kell

I let you know on Friday that the refund would be a pro-rated amount of the $123.29 that you paid, but I did NOT say that we would base that amount on a 6 month premium of $123.29 as that was not the correct cost for the coverage provided. Iím sorry if you misunderstood that.

END of emails

So, it would seem that State Farm can just change their minds a couple of days after one signs and pays for an agreed auto policy amount, or even a couple of months later in the case of the woman who had her RV insured, and expect you to cough up and pay without notifying you of this change? Especially when they did not discuss or mention or allude to any discounts, ever? Not ethical and certainly not good business practice.

If a customer has to potentially pay more for whatever reason/s, surely the decent and courteous and ethical thing to do would be to approach that customer first, not just go ahead and do it and keep quiet, or send them an invoice without any details as to why they are being billed? And then expect them to be responsible for the higher rate and insist they pay it? To me that's bullying me to pay for their mistakes and it's plain underhanded and deceitful.

The bottom line is that as a consumer, the price you see (or are quoted) is the price you pay. Period. You make a mistake, you eat it, or at the very least, call the customer and discuss it with them.

I received a check in the amount of $94.18 on the 6th November 2017. I went back to the Colorado Department of Insurance and said I would like to pursue this problem so they went ahead (agreeing with me) and sent State Farm another letter. This is the State Farm reply I got yesterday, 13 November 2017. Also enclosed was a letter from Kell.

State Farm's reply.

Contact me at: pettprojects@yahoo.com

© Adrienne Petterson 2017. Index

Sent: Monday, October 30, 2017 10:38 AM

To: Kreg Kell

Subject: Cancellation on Auto Insurance

Just to confirm that my auto insurance will terminate at the end of the day on Tuesday 31st October 2017 and that a pro-rated refund based on the amount I paid, $123.29, will be refunded to me. I will wait for your email confirmation.

Thank you,

Adrienne Petterson

Kreg Kell

Oct 30 at 10:45 AM

To Adrienne Petterson

Good morning Adrienne,

From: Adrienne Petterson [mailto:pettprojects@yahoo.com]

Sent: Monday, October 30, 2017 10:47 AM

To: Kreg Kell

Subject: Re: Cancellation on Auto Insurance

Thanks,

Adrienne

Kreg Kell

Oct 30 at 3:38 PM

To Adrienne Petterson

Sent: Monday, October 30, 2017 3:41 PM

To: Kreg Kell

Subject: Re: Cancellation on Auto Insurance

Thank you.

Adrienne

Oct 30 at 3:53 PM

To Adrienne Petterson

Where was I given the option of accepting or declining these two discounts or increases? I was not given a choice or an option. None of this was discussed with me let alone explained. Underhanded behavior on State Farm's part. Yet I am supposed to be responsible for their mistake and pay the difference and not complain. I don't think so.

Please add your name to my list of disgruntled State Farm customers below. It's time we stood up for ourselves, their bread and butter.

Kell's Letter to Me

Refund Check

LIST OF DISGRUNTLED STATE FARM CUSTOMERS!

Adrienne Petterson, Fountain, CO

Hugh M, Fountain, CO